when are property taxes due in illinois 2019

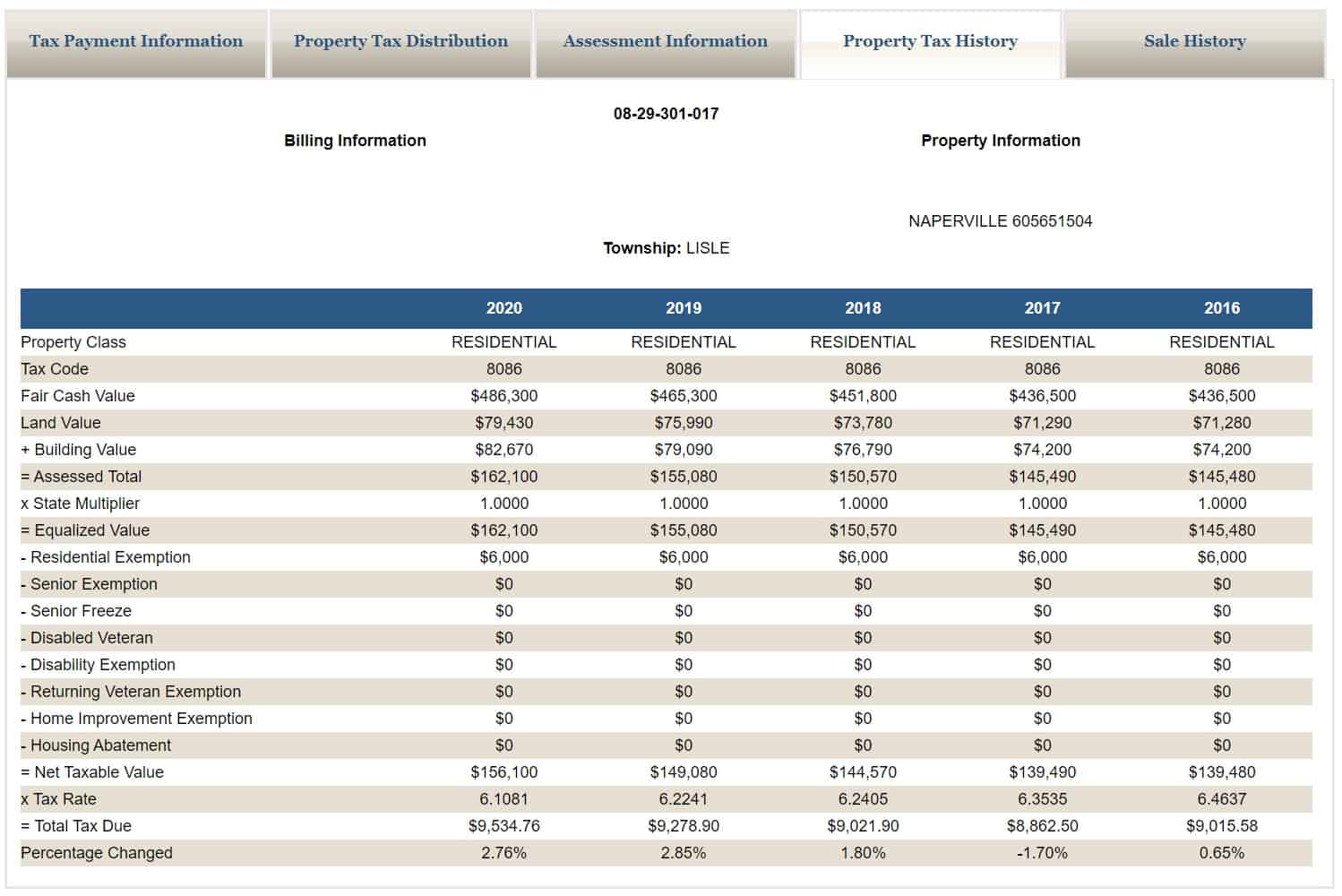

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Conducts annual sale of delinquent real.

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

. For now the September 1. Assists the County Board in formulating budgets financial plans and projections. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

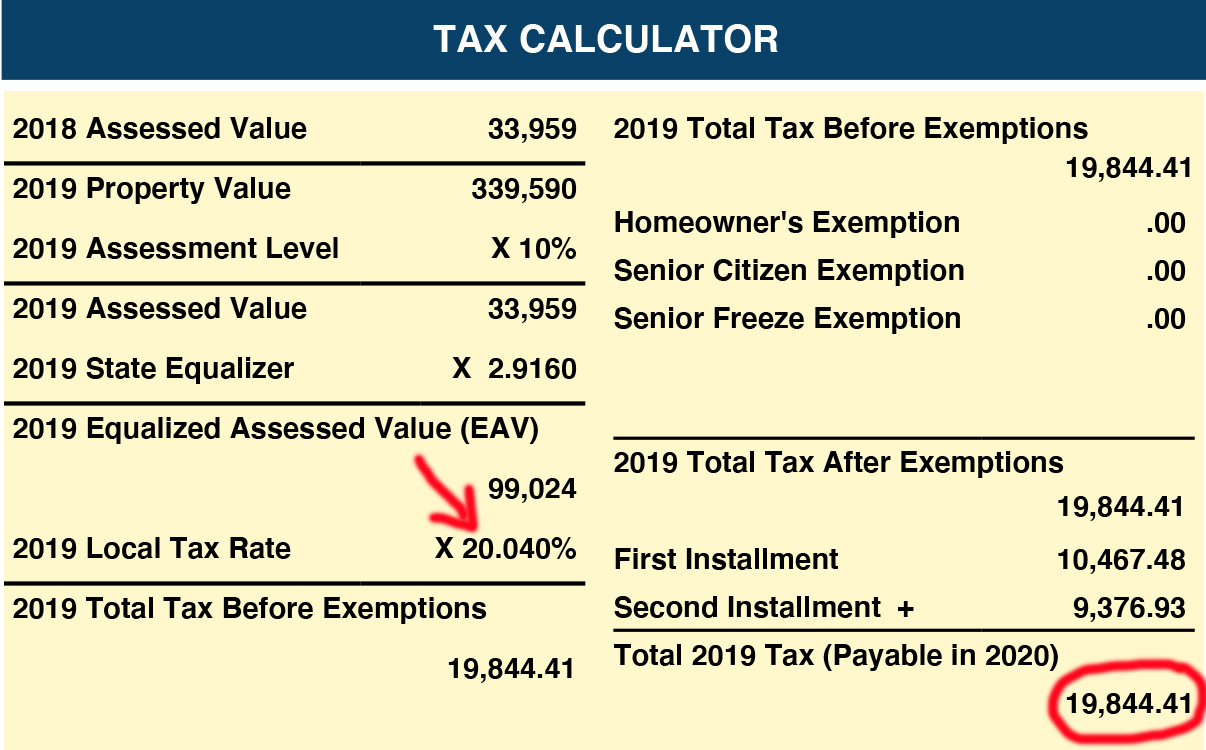

Property tax due dates for 2019 taxes payable in 2020. The First Installment must be paid by June 4 2019 with. 173 of home value.

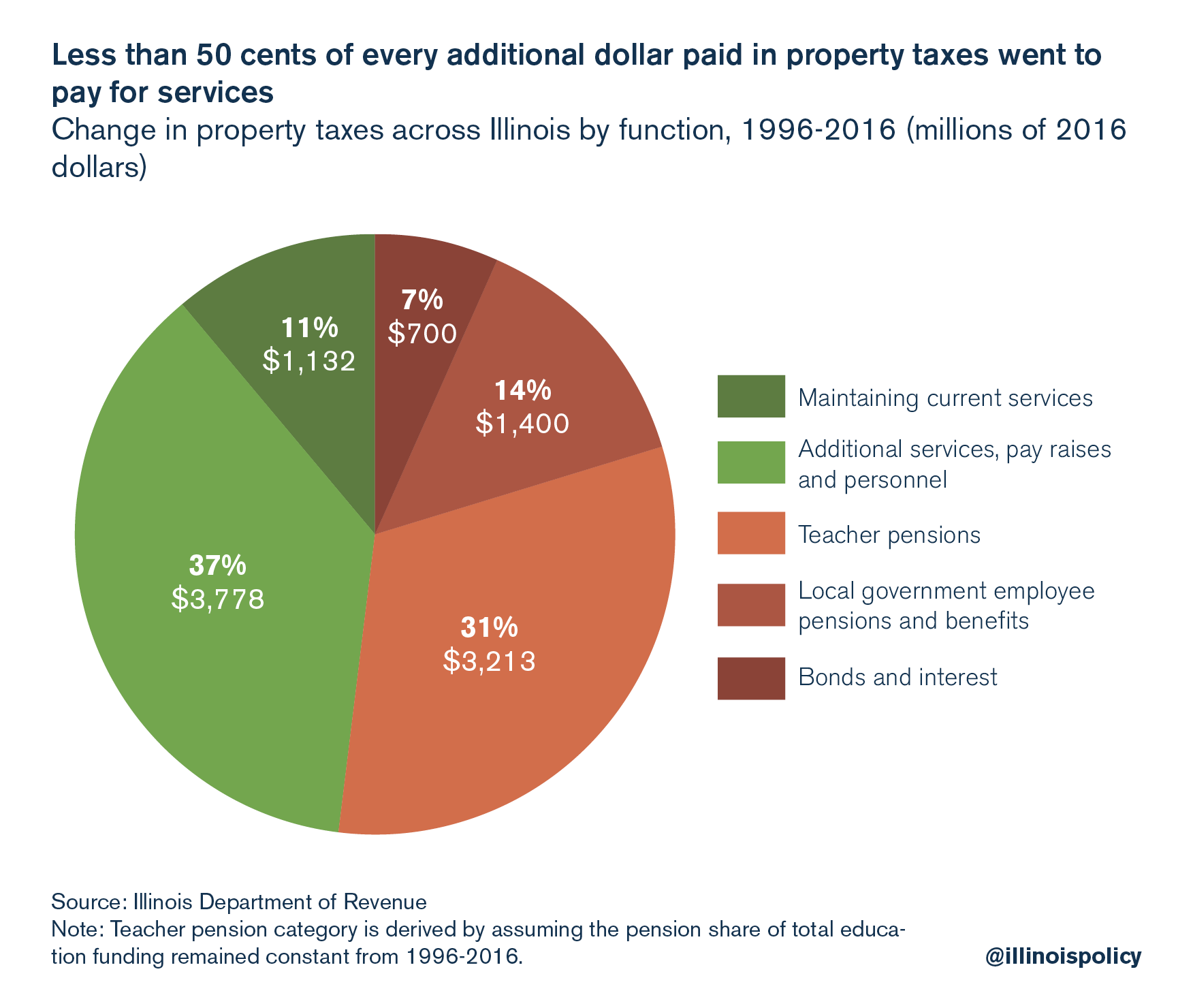

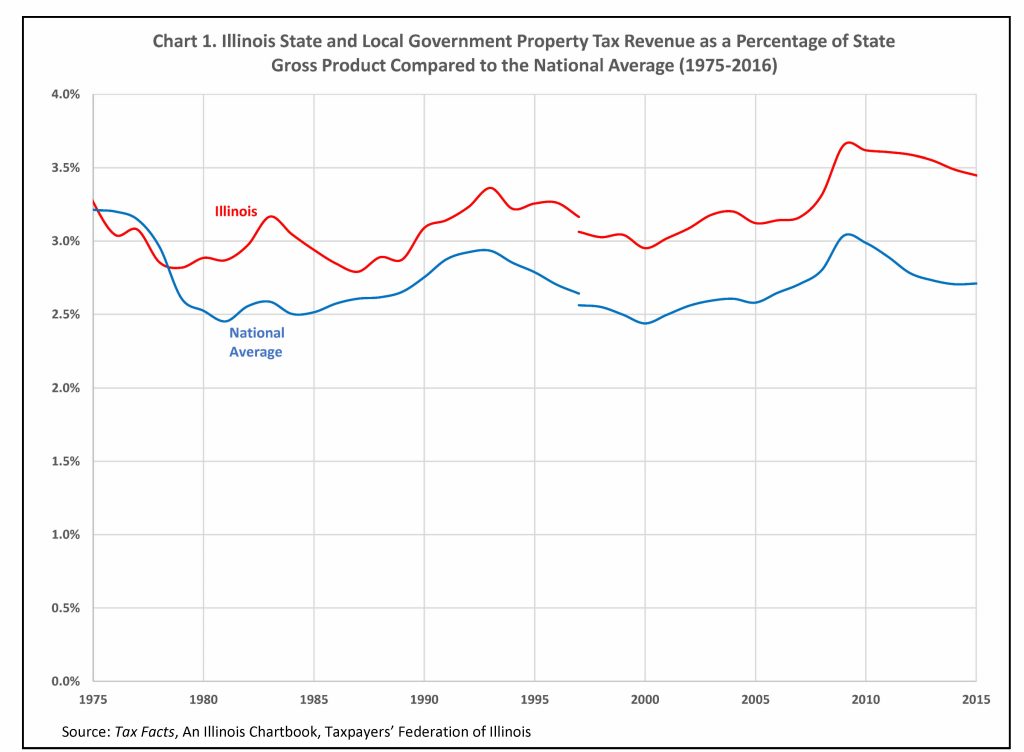

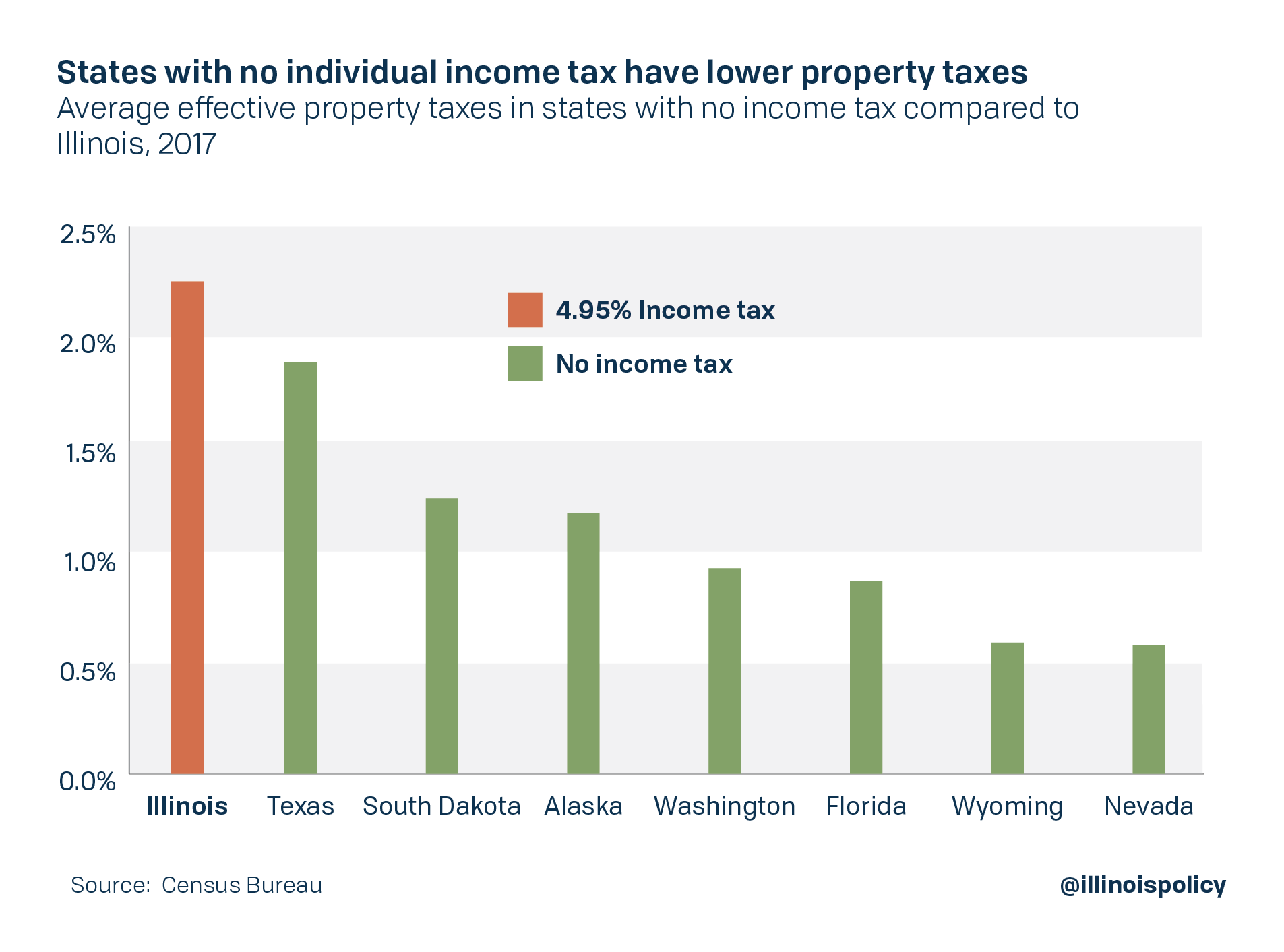

Property taxes in Illinois have been on the rise in recent years. Reducing Your Tax Bill. Yes to did you own your primary residence.

Billing and Collection of nearly 66 million real estate taxes. NYC property tax could be paid quarterly if the home value exceeds 250000 or semi-annually. Property tax due dates for 2019 taxes payable in 2020.

Illinois holds the second-place record for having. Has yet to be determined. The average homeowner in Illinois paid 4737 in property taxes the second highest amount in the nation.

Are Illinois property taxes extended. For now the September 1 deadline for the second installment of property taxes will remain unchanged. It is managed by the local governments including cities counties and taxing districts.

Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due during the next. These bills are for taxes owed in 2018.

The deadline for each quarterly instalment is July 1 October 1 January 1 and. This ARTICLE On Illinois Home Values Decline Due To Rising Property Taxes Was PUBLISHED On December 7th 2019. Tax Year 2021 Second Installment Property Tax Due Date.

April 12 2021 1140 AM. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. 1 day agoEDWARDSVILLE Madison County Treasurer Chris Slusser is reminding taxpayers that the third installment of their tax bill is coming due on Friday Oct.

Will County will mail real estate property tax bills on Wednesday May 1 2019. The mailing of the bills is dependent on the completion of data by other local. Corporate purposes general fund including amounts for fire protection ambulance services and imrf.

The Second Installment of 2020 taxes is due August 2 2021 with application of late. Tax amount varies by county. Are Illinois property taxes extended.

2019 payable 2020 tax bills are. 715 AM - 515 PM. Your real estate tax deduction for 2020 2019 taxes in Illinois are billed in 2020 is what you paid.

In most counties property taxes are paid in two installments usually June 1 and September 1. Due dates are June 6 and Sept. The Illinois Department of Revenue does not administer property tax.

The typical homeowner in illinois pays 4527 annually in. Welcome to Madison County Illinois.

Taxpayers Federation Of Illinois A New Property Tax Relief Tax Force Same Old Problems Mike Klemens

Illinois Realtors Defeats Five Home Rule Initiatives Illinois Realtors

Winnebago County Offers Waiver Of Late Fees On 1st Installment Of Property Taxes

Fix Or Sell Illinois High Property Taxes Make Either Tough

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

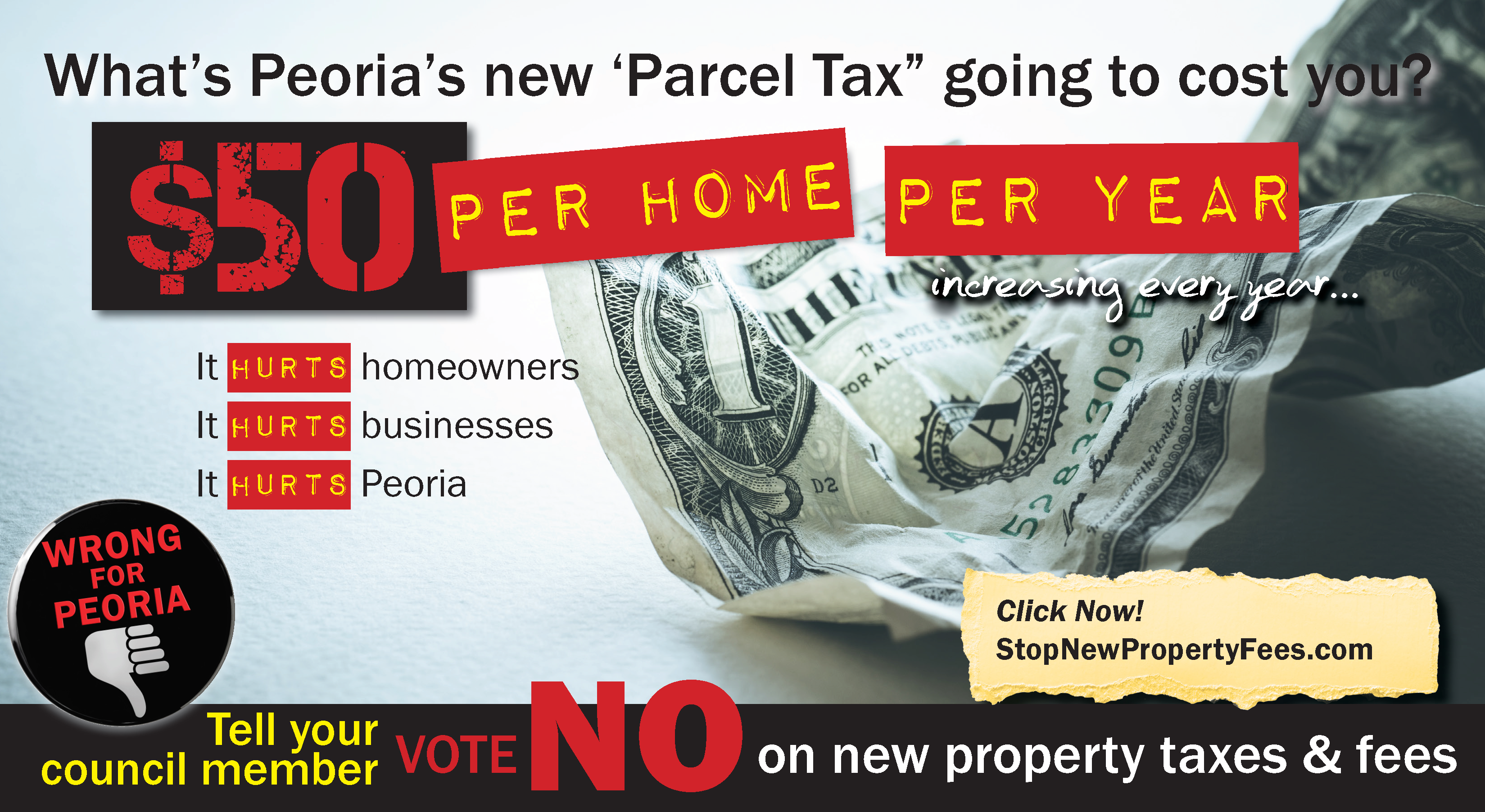

With Advocacy Everywhere Illinois Realtors Rally Peoria Voters Against New Parcel Tax On Property Owners

Taxes And Your Illinois Divorce The Gitlin Law Firm

2019 Real Estate Taxes Livingston County Illinois

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

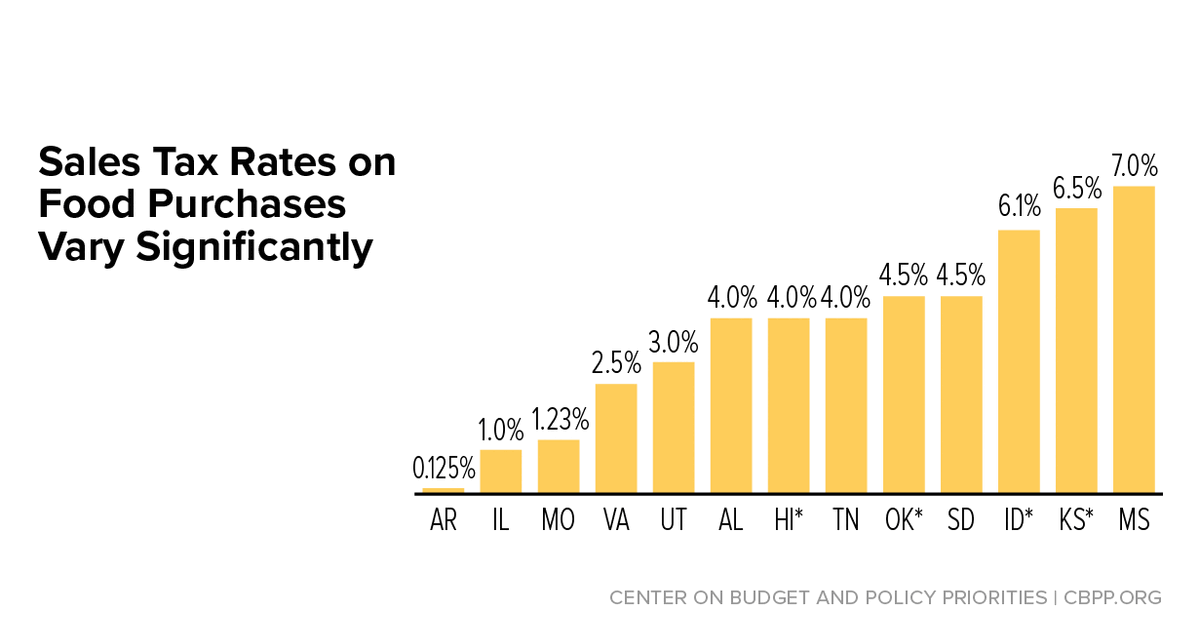

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

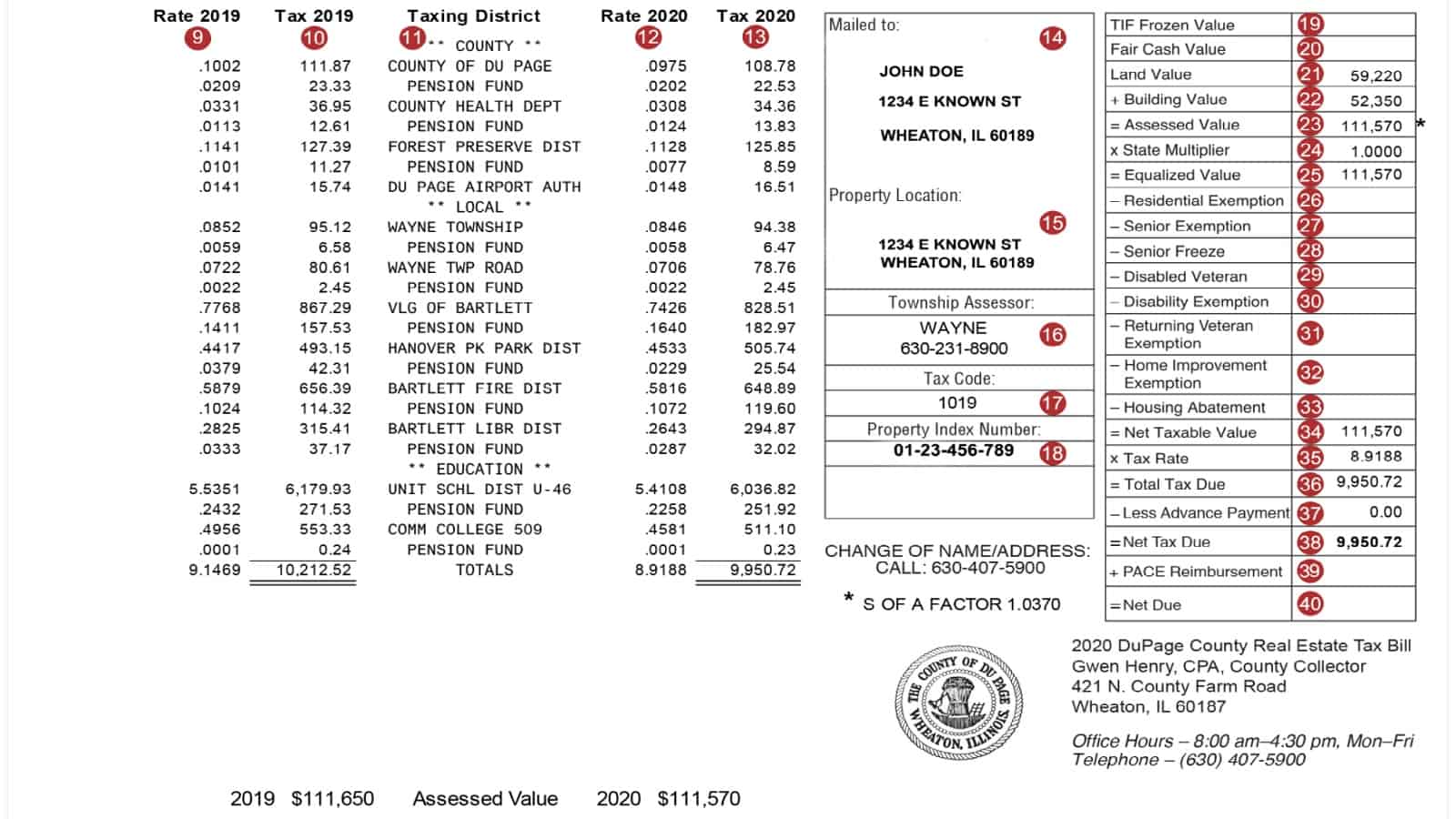

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

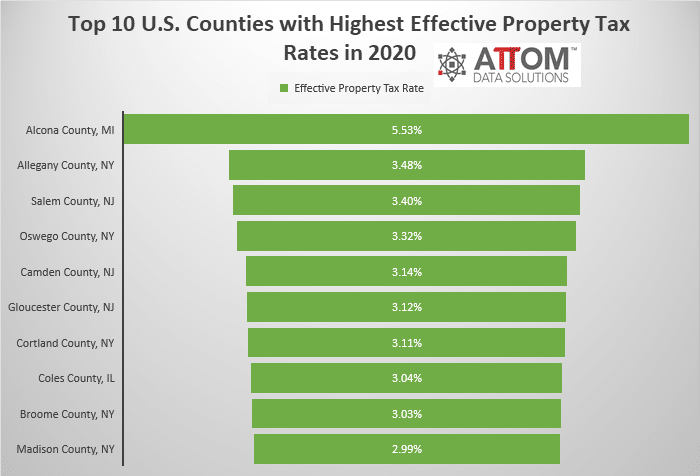

Study Illinois Property Taxes Still Second Highest In Nation

Uncategorized Property Tax Bill Appeals For Cook County Illinois

Problem With Lake County Property Tax Bill Problems Identified Dick Barr Lake County Board Member District 3

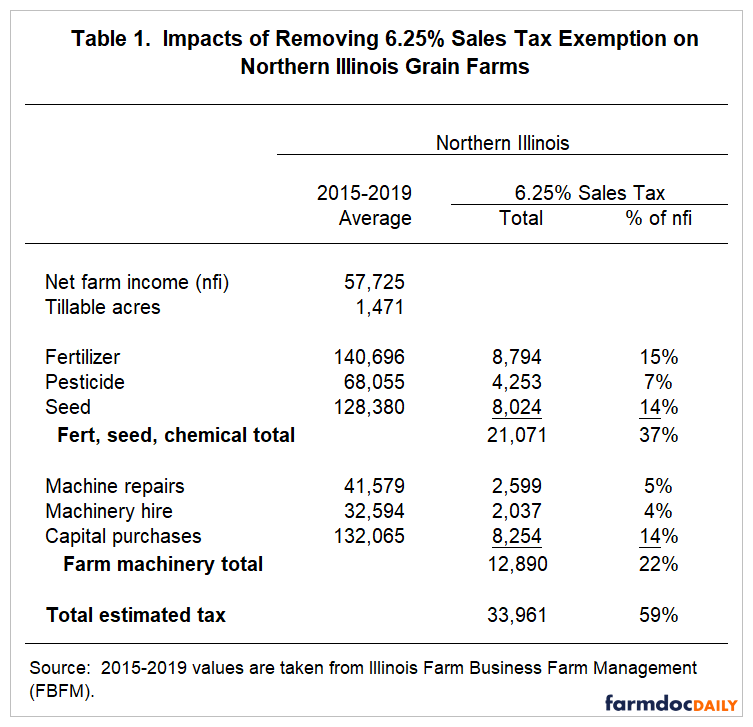

Impacts Of Removal Of Illinois Sales Tax Exemptions On Illinois Grain Farms Farmdoc Daily

New Illinois Laws 2019 Taxes Revenue Fees Oak Lawn Il Patch

Keicher To Host Property Tax Seminar For Dekalb County Residents

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Top 10 U S Counties With Highest Effective Property Tax Rates Attom